<?xml encoding=”utf-8″ ?????????>

Raspberry Pi has confirmed its intention to pursue an IPO in London in a win for the city’s beleaguered stock exchange.

It is London’s first major listing since Air Astana in February, raising investor hopes for a bounce back in the city’s fortunes after high-profile companies, such as Arm and CRH, moved their main listings to New York in recent years.

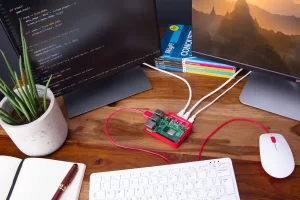

Raspberry Pi was founded in 2012 as an educational start-up, selling affordable single board computers to enthusiasts and hobbyists. However, the success of the company’s products and their application to a range of other industries, such as security cameras and ventilation, mean that 70% of the company’s revenue last year came from sales to business users. As CEO and co-founder, Eben Upton, explained: “from the very beginning we saw customers using our products in a staggering variety of applications across a broad swathe of markets”.

Nevertheless, education has remained at the heart of the company’s ethos. The Raspberry Pi Foundation was set up in 2008 to promote interest in computer science in children and is a registered UK-based charity. The Foundation’s goals include providing resources for schools on computing and digital technologies, and enabling young people to learn outside of school through online resources, clubs, and competitions. The Foundation currently offers coding courses in Python and Unity, alongside courses in AI, encryption, and cybersecurity for teachers, among many others.

Rotem Farkash, a tech entrepreneur and expert in cybersecurity, believes that the company’s strong sense of mission points to its successful long-term prospects: “private and business customers are increasingly looking to align themselves with companies that represent their values. Raspberry Pi’s continued charitable work will be of interest to investors looking to partner for the long term.” Farkash also praised the Foundation’s offering of encryption and cybersecurity courses, which he considers “essential skills” for young people to protect themselves and their personal information online.

Raspberry Pi themselves have been keen to emphasise that the IPO will only strengthen their charitable offering. CEO Upton explained that: “this IPO brings the opportunity to double down on [the Foundation’s] outstanding work to enable young people to realize their potential through the power of computing”. After the IPO, the Foundation will remain a major shareholder in the company, and has received over $50m (£40m) in dividends since 2013.

The company equally remains committed to sustainability in its manufacturing processes, and is expected to received a London Stock Exchange Green Mark upon listing. The company claims that its computing units use 90% less wastewater in production than legacy desktop or embedded PCs, 85% less casing plastic and consume 90% less electricity, and are all manufactured at the Sony Technology Centre in Pencoed, Wales, where, according to the company’s official magazine, “Sony is taking active steps toward reducing its environmental impact”.

The IPO also points to the continued strength of the UK tech market, which has suffered from the high-profile departure of Arm, the semiconductor manufacturer, to the New York Stock Exchange, and from the pressure of America’s ‘Magnificent Seven’ technology companies in developing machine learning products.

Professor Sir Richard Friend, fellow of the Royal Academy of Engineering, stressed that the UK remains an innovative and supportive environment for tech and engineering start-ups: “Companies like Raspberry Pi epitomise the value that the engineering community brings to the UK and their decision to list here is very important for our tech community. Raspberry Pi is a fantastic example of the sort of world-leading engineering innovation of which the UK is capable of creating and scaling.”

The company is targeting a valuation of $630 million (£500 million) and has appointed Jeffries and Peel Hunt as joint bookrunners.